Introduction to Bitcoin Price on Crypto30x.com

Bitcoin has become the most widely discussed digital asset in the world, and its price fluctuations attract investors, traders, and even curious beginners on a daily basis. At Crypto30x.com, users often search for real-time updates and detailed analysis of the Bitcoin price to guide their financial decisions. Unlike traditional assets, Bitcoin does not have a fixed value determined by a single authority. Instead, its price is the result of continuous demand and supply movements across multiple global exchanges. For investors, understanding these dynamics is not just a matter of curiosity it’s a critical factor in making profitable decisions and avoiding risks.

Crypto30x.com positions itself as a platform that provides clarity, expert perspectives, and educational resources, ensuring that users can interpret Bitcoin’s market performance in a meaningful way. This article dives deep into everything you need to know about the Bitcoin price, including how it is determined, what factors influence it, historical patterns, and future projections.

How Bitcoin Price is Determined

The price of Bitcoin is not issued by a central bank or government; instead, it is driven by what buyers are willing to pay and what sellers are willing to accept at any given time. On exchanges such as Binance, Coinbase, and Kraken, thousands of orders are placed every minute. This dynamic creates a “spot price” that updates continuously.

When you check Crypto30x.com Bitcoin Price, what you see is essentially an aggregate of these trading values. This is why prices may slightly differ from one exchange to another, but the overall global average remains consistent. The higher the trading volume, the more reliable the listed price becomes.

The decentralized nature of Bitcoin means that its valuation is transparent, fluid, and influenced by real market activity rather than being manipulated by a single authority. This is one of the primary reasons why traders appreciate Bitcoin—it reflects pure market sentiment.

Key Factors Influencing Bitcoin Price

Several external and internal factors directly impact Bitcoin’s value. For readers of Crypto30x.com, it is important to understand these elements so they can anticipate potential movements in the market.

1. Supply and Demand

Bitcoin has a fixed maximum supply of 21 million coins, which creates scarcity. As adoption grows, demand for Bitcoin increases, driving prices higher. Conversely, when interest decreases, the price can fall sharply.

2. Market Sentiment

Positive news, such as institutional adoption or approval of Bitcoin ETFs, often pushes prices upward. On the other hand, regulatory crackdowns or exchange collapses can trigger massive sell-offs.

3. Halving Events

Every four years, Bitcoin undergoes a halving process where mining rewards are cut in half. This reduces the rate at which new coins are introduced, creating scarcity and often leading to upward price trends.

4. Global Economic Conditions

Bitcoin is often referred to as “digital gold” because investors turn to it during times of inflation or financial instability. When traditional markets struggle, Bitcoin sometimes benefits as a hedge asset.

5. Technological Upgrades

Network improvements such as the Lightning Network or Taproot upgrade can boost investor confidence, further impacting demand and therefore the price.

Historical Overview of Bitcoin Price

Bitcoin’s journey has been nothing short of dramatic, and understanding its historical movements helps explain why its price is so closely monitored today.

- 2009 – 2012: Bitcoin was virtually unknown, trading for pennies. Early adopters often mined or exchanged coins for negligible amounts.

- 2013 – 2016: The first major bull run pushed Bitcoin past $1,000 before it corrected back to the low hundreds. This era showed that BTC was capable of exponential growth.

- 2017: Bitcoin shocked the financial world by reaching $20,000, attracting mainstream attention but also leading to a dramatic crash.

- 2020 – 2021: Amid the global pandemic and institutional investment, Bitcoin surged to an all-time high of nearly $69,000.

- 2022: The market corrected significantly, with Bitcoin falling below $20,000 due to macroeconomic challenges and crypto exchange failures.

- 2023 – 2024: Recovery signs emerged as Bitcoin regained momentum, with discussions around Bitcoin ETFs adding to its credibility.

This timeline demonstrates that Bitcoin is volatile but also resilient. Despite crashes, it has always rebounded stronger, proving its long-term value proposition.

Why Check Bitcoin Price on Crypto30x.com?

While there are many financial platforms online, Crypto30x.com aims to provide more than just a number. The platform integrates real-time updates, educational resources, expert opinions, and trend analysis that help users make better decisions.

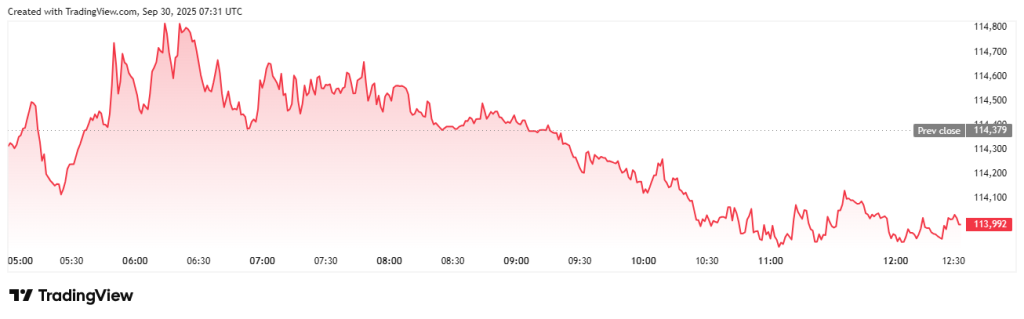

- Real-time charts: Always updated with the latest values.

- Analyst insights: Interpretations of why Bitcoin is moving up or down.

- Beginner guides: Helping newcomers understand the basics of cryptocurrency investing.

- Market comparisons: Showing how Bitcoin stacks up against Ethereum, Litecoin, and other coins.

By visiting Crypto30x.com, readers are not only checking Bitcoin’s current value but also gaining a broader perspective on what that number means for their investment journey.

Bitcoin Price Volatility Explained

Volatility is both the biggest challenge and opportunity in Bitcoin trading. Prices can swing by thousands of dollars in a single day. While this creates risks for cautious investors, it also generates opportunities for traders who thrive on short-term movements.

Crypto30x.com helps its audience by breaking down volatility into understandable patterns, showing both the risks and potential rewards. For instance, during bullish cycles, Bitcoin often experiences 20–30% pullbacks before resuming upward trends. On the bearish side, sudden news events can cause panic selling, but savvy investors use these drops as entry points.

Understanding volatility through professional explanations allows users to approach Bitcoin not as a gamble but as a calculated investment.

Future Predictions for Bitcoin Price

No one can predict Bitcoin’s price with absolute certainty, but trends and expert analyses provide valuable guidance.

- Short-Term Outlook (2025): Analysts expect Bitcoin to fluctuate between $60,000 and $85,000, depending on macroeconomic conditions and ETF adoption.

- Medium-Term Outlook (2026 – 2028): The next halving in 2028 could drive Bitcoin beyond $100,000, as history has shown halving events usually spark bull runs.

- Long-Term Outlook (2030 and Beyond): Many experts believe Bitcoin could rival gold as a store of value, potentially reaching $250,000 or higher.

Crypto30x.com emphasizes caution, reminding users to balance optimism with risk management. While the upside is significant, the unpredictable nature of Bitcoin means investors must stay informed.

Comparing Bitcoin Price with Other Assets

To understand Bitcoin’s true potential, it is important to compare it with other traditional and digital assets.

| Asset | Current Value Trend | Volatility | Long-Term Growth Potential | Liquidity |

|---|---|---|---|---|

| Bitcoin (BTC) | Highly dynamic | Very high | Strong, limited supply | High |

| Gold | Relatively stable | Low | Moderate, traditional hedge | High |

| Stocks (S&P 500) | Steady growth | Moderate | Strong historical performance | High |

| Ethereum (ETH) | Growing | High | Significant, smart contract ecosystem | High |

| Real Estate | Stable | Low | Strong but less liquid | Medium |

This table illustrates that while Bitcoin carries higher risks, it also offers unmatched growth potential compared to traditional investments.

Risks of Investing in Bitcoin

While Bitcoin presents huge opportunities, it is not without risks. Crypto30x.com stresses the importance of balanced decision-making.

- Regulatory Uncertainty: Governments worldwide are still deciding how to regulate Bitcoin. Sudden laws can affect prices.

- Security Concerns: Although the Bitcoin network itself is secure, exchanges and wallets can be hacked.

- Emotional Trading: Many investors lose money by panic selling or FOMO buying without proper strategy.

- Market Manipulation: Whales, or large investors, can move the market with big trades.

By acknowledging these risks, investors can prepare strategies that protect their capital while benefiting from Bitcoin’s growth.

Expert Insight: My Personal Experience Watching Bitcoin Price

As someone who has been actively following Bitcoin since its early years, I have seen firsthand how unpredictable yet rewarding this asset can be. During the 2017 bull run, I witnessed many beginners make fortunes, only to lose much of it in the 2018 crash. Similarly, in 2020, those who held through the panic reaped massive rewards by late 2021.

From my experience, the key lesson is patience. Bitcoin rewards those who approach it with a long-term perspective, rather than chasing quick profits. At Crypto30x.com, we share these insights so that new investors don’t repeat common mistakes.

Conclusion – Crypto30x.com Bitcoin Price as Your Reliable Source

The Bitcoin price is more than just a number—it is a reflection of global economic conditions, investor psychology, and technological progress. For investors, traders, and even casual observers, understanding the factors behind Bitcoin’s value is critical to making informed financial decisions.

At Crypto30x.com, you don’t just check the price—you gain access to a broader context that empowers you to act with confidence. Whether you are a beginner learning the ropes or an experienced trader searching for deeper analysis, Crypto30x.com ensures that your decisions are guided by knowledge rather than speculation.

Bitcoin’s journey is ongoing, and while its price may fluctuate, its role as a revolutionary financial asset continues to grow. For those who wish to stay ahead, monitoring the Bitcoin price on Crypto30x.com is not just helpful—it is essential.

FAQs About Bitcoin Price on Crypto30x.com

Why does Bitcoin price change so often?

Because it is determined by supply and demand across multiple exchanges, influenced by news, adoption, and global markets.

Is Bitcoin price the same on every platform?

Not exactly—slight variations exist between exchanges, but the global average is consistent.

Can Bitcoin reach $100,000?

Yes, many analysts believe Bitcoin could surpass $100,000, especially after future halving events.

Is Bitcoin safe for beginners?

Bitcoin itself is secure, but beginners must use trusted exchanges and wallets to avoid risks.

Why should I use Crypto30x.com to check Bitcoin price?

Because it provides not only the real-time price but also expert insights, guides, and detailed market analysis.