Introduction to Quantum Computing Stocks

Quantum computing stocks have become one of the most discussed topics among technology investors looking for the next big breakthrough. Quantum computing represents a major shift from classical computing, promising to solve complex problems that are currently impossible for even the fastest supercomputers.

It’s essential to clarify that quantum computing stocks (quantum technology stocks, quantum computing investment, emerging tech stocks, future technology investments, quantum market trends) are early-stage, high-potential investments. While the technology is still developing, many investors view quantum computing stocks as a long-term opportunity similar to early internet or semiconductor investments.

What Are Quantum Computing Stocks?

Quantum computing stocks are shares of companies involved in the research, development, or commercialization of quantum computing technologies. These companies may focus on hardware, software, algorithms, cloud access, or supporting infrastructure.

In simple terms:

Quantum computing stocks allow investors to gain exposure to companies building next-generation computing systems.

These stocks range from pure-play quantum startups to large technology firms with quantum research divisions.

Why Quantum Computing Stocks Are Gaining Attention

Interest in quantum computing stocks is growing rapidly due to several factors:

- Breakthroughs in quantum hardware

- Increased government funding

- Enterprise interest in quantum advantage

- Potential disruption across industries

- Media and analyst coverage

Quantum computing stocks are seen as a future-defining investment theme rather than a short-term trend.

Cloud Computing: Digital Transformation

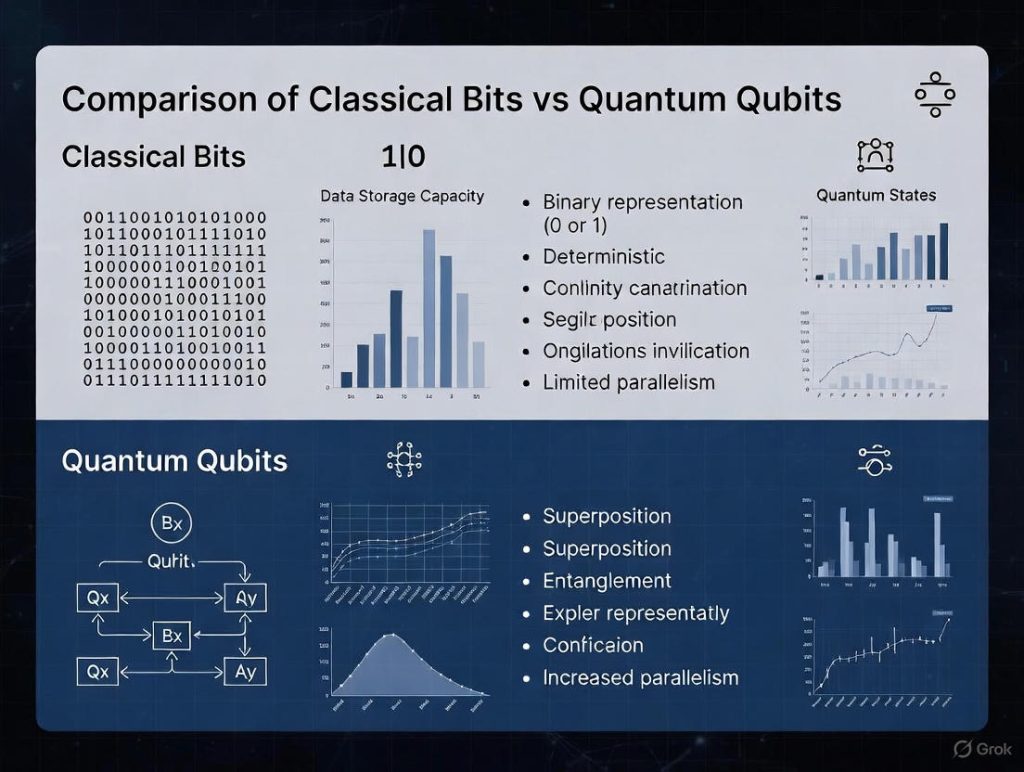

How Quantum Computing Technology Works

Understanding the basics helps investors evaluate quantum computing stocks more realistically.

Key Concepts

- Qubits instead of bits

- Superposition and entanglement

- Parallel computation

- Quantum algorithms

Because quantum computers process information differently, companies behind quantum computing stocks aim to unlock massive computational power.

Types of Companies in Quantum Computing Stocks

Not all quantum computing stocks are the same. They fall into several categories.

1. Quantum Hardware Companies

Focus on building quantum processors, qubits, and systems.

2. Quantum Software and Algorithms

Develop tools, programming languages, and optimization software.

3. Cloud and Platform Providers

Offer quantum computing access via the cloud.

4. Supporting Technology Companies

Provide cryogenics, materials, sensors, and control systems.

AI Accounting Tools: Finance Automation

Diversifying across these categories can reduce risk when investing in quantum computing stocks.

Key Growth Drivers for Quantum Computing Stocks

Several long-term factors support the growth potential of quantum computing stocks.

Major Growth Drivers

- Drug discovery and healthcare research

- Financial modeling and risk analysis

- Cryptography and cybersecurity

- Artificial intelligence acceleration

- Climate and materials simulations

As real-world use cases expand, quantum computing stocks may see increased adoption and valuation.

Risks and Challenges of Quantum Computing Stocks

Despite excitement, quantum computing stocks carry significant risks.

Key Risks

- Technology still in early stages

- Long commercialization timelines

- High research and development costs

- Uncertain profitability

- Market hype and volatility

Investors should treat quantum computing stocks as high-risk, high-reward assets.

Quantum Computing Stocks vs Traditional Tech Stocks

Comparing quantum computing stocks with traditional tech stocks highlights important differences.

| Feature | Quantum Computing Stocks | Traditional Tech Stocks |

| Market Maturity | Early-stage | Established |

| Volatility | High | Moderate |

| Revenue Stability | Low | High |

| Growth Potential | Very high | Moderate |

| Risk Level | High | Lower |

Quantum computing stocks are better suited for investors with a long-term horizon.

How to Invest in Quantum Computing Stocks (HowTo Schema Section)

HowTo: Invest in Quantum Computing Stocks Wisely

Step 1: Learn the basics of quantum computing

Step 2: Identify companies involved in quantum research

Step 3: Diversify across multiple quantum computing stocks

Step 4: Evaluate financial health and partnerships

Step 5: Invest with a long-term mindset

This HowTo approach reduces emotional decision-making and improves investment discipline.

Long-Term vs Short-Term Strategy for Quantum Computing Stocks

Long-Term Investors

- Focus on technology leadership

- Accept volatility

- Hold through development cycles

Short-Term Traders

- Trade news and announcements

- Manage risk tightly

- Expect high price swings

Most experts agree quantum computing stocks are better suited for long-term investment strategies.

Role of Governments and Research in Quantum Computing Stocks

Public investment plays a major role in the future of quantum computing stocks.

Government Influence

- Research funding

- National quantum initiatives

- University partnerships

- Defense and security interest

Strong government backing supports the long-term outlook of quantum computing stocks.

Future Outlook for Quantum Computing Stocks

The future of quantum computing stocks depends on technological milestones.

What to Watch

- Error-corrected qubits

- Scalability breakthroughs

- Commercial quantum advantage

- Enterprise adoption

- Standardization of platforms

As milestones are achieved, quantum computing stocks could enter a new growth phase.

Who Should Invest in Quantum Computing Stocks?

Quantum computing stocks are suitable for:

- Long-term growth investors

- Technology-focused portfolios

- Investors comfortable with volatility

- Those seeking diversification into emerging tech

They are not ideal for conservative or short-term income investors.

FAQs on Quantum Computing Stocks (FAQ Schema Ready)

What are quantum computing stocks?

They are stocks of companies developing quantum computing technologies.

Are quantum computing stocks risky?

Yes, they are high-risk due to early-stage technology.

Do quantum computing stocks have long-term potential?

Many analysts believe they have strong long-term growth potential.

Can beginners invest in quantum computing stocks?

Yes, but only with proper research and risk management.

Are quantum computing stocks profitable now?

Most are still in development and not consistently profitable.

How should I diversify quantum computing stocks?

By investing across hardware, software, and platform companies.

Conclusion: Are Quantum Computing Stocks Worth It?

Quantum computing stocks represent one of the most exciting—and uncertain—investment opportunities of the modern technology era. While the technology is still evolving, its potential to reshape industries is undeniable.

For investors willing to accept risk, volatility, and long development timelines, quantum computing stocks offer exposure to a future where computing power reaches unprecedented levels. As with any emerging technology, informed decision-making and patience are key.